Ashley Gold Receives Howie Exploration Permit and Ontario Junior Exploration Program Funding

Ashley Gold Receives Howie Exploration Permit and Ontario Junior Exploration Program Funding Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the

The Kawashegamuk Lake area became known as the "New Klondike" after the 1896-1899 gold rush in Klondike, Yukon. This area has been known to host several large-scale gold deposits.

High priority target areas have been identified through previous drill history, rock sampling and surveying with proven gold occurrences that require additional follow up exploration.

With main access roads along the Trans-Canada #17 highway and a working season that is considered to be year-round, this property can make for excellent news flow.

Kenora Mining District

Au-Ag

Advanced Stage – Drilling

100% Ashley Gold Corp

4,000 HA

Shear-zone hosted / Intrusion-related Au Systems

Ashley Gold Corp

Continued drilling/exploration

The acquisition of the Tabor Lake Mine and the Sakoose Mine completes Ashley’s ultimate goal of strategically acquiring multiple claim groups to consolidate into one large 4000 hectare property.

The property is located approximately 40 km southeast of Dryden, Ontario and is readily accessible by travelling 35 km east of Dryden via Trans-Canada Highway (Hwy 17) then heading south approximately 7 km on an all season maintained gravel logging road known as Snake Bay Road for 7 km. From this point, Camp 33 Road and numerous historic logging roads head east for 5 km and transect the project providing additional access throughout the region.

The project is centrally located within the prolific Wabigoon Greenstone Belt in western Ontario with numerous significant multi-million ounce gold reserves including Treasury Metals’ Goliath and Goldlund, New Gold’s Rainy River, Agnico Eagle’s Hammond Reef, and First Mining’s Cameron deposits. The Greenstone belt lies within the western Wabigoon Subprovince, a granite-greenstone terrane of the Superior Province. A number of thick volcano-sedimentary sequences consisting of mafic to felsic lavas and associated intrusions and pyroclastic rocks, all of which are generally overlain by sedimentary sequences, characterize the belt. Gold-bearing mineralized zones on the project are focused in a northwest-southeast corridor within both greenstone and porphyritic intrusions.

Historical workings within the Tabor Mine lease consist of a 275’ (~84m) vertical shaft with two horizontal crosscuts at the 125’ (~38m) and 250’ (~76m) levels both of which intersected high-grade gold-bearing quartz-carbonate vein systems which were drifted and an unspecified quantity of ore extracted noted to grade an average of at least 0.34 oz/t (10.58 g/t) Au up to 1.36 oz/t (42.43 g/t) Au.

At least nine (9) individual veins have been encountered in past exploration, both on surface and in drilling ranging in thickness from 6” (15cm) to 5’ (~1.5m) in width with several high-grade intercepts. The main “A” Vein extends from surface where an open-cut bulk sample of 77 tons averaging 16.8 g/t Au was extracted to a minimum vertical depth of 400’ (125m). The “A” Vein was also intersected and drifted on the 125’ level where a bulk sample of 1.75 tons averaging 42.43 g/t Au was extracted during resampling efforts in the 1980’s. Historic drilling and exploration also note at least three (3) additional parallel veins between the 225’ (70m) and 425’ (130m) vertical depths with highlights of 26.95 oz/t (838.24 g/t) Au over 3’ (0.9m), 4.95 oz/t (153.96 g/t) Au over 3’ (0.9m), and 1.93 oz/t (60.03 g/t) Au over 3’ (0.9m).

*Please note, the gold grades, depths, and widths of drilling intercepts, historic workings architecture and average mining grades, and bulk sample sizes and grades are all historic in nature and non-compliant to the current 43-101 standards of reporting and cannot be accurately verified by the issuer at this time.

Table 1. Results for Maiden Drill Program.

Hole No. | From (m) | To (m) | Interval (m)* | Au (g/t) |

TL-23-001 (Mineralized Zone) | 57.50 | 65.50 | 8.00 | 5.23 |

Including | 60.50 | 61.50 | 1.00 | 41.00 |

TL-23-002 | 110.00 | 112.00 | 2.00 | 0.40 |

TL-23-003 | 32.00 | 33.00 | 1.00 | 11.60 |

TL-23-004 | 31.00 | 32.00 | 1.00 | 2.94 |

TL-23-005 | 69.30 | 70.30 | 1.00 | 1.11 |

Table 2. Metallic Screen Results.

TL-23-001 60.5m to 61.5m Metallic Screening | Value |

Au +100 mesh (g/t) | 535 |

Au – 100 mesh (A) (g/t) | 33.1 |

Au -100 mesh (B) (g/t) | 33.6 |

Total Au (g/t) | 41 |

Weight +100 mesh (g) | 28 |

Weight -100 mesh (g) | 1812 |

Total Weight (g) | 1840 |

Option incudes a 5km fold hinge trend between the Tabor and Sakoose Mine

Historical production at Sakoose reported as 8,828 tons at 11.9 g/t Au*

Tabor assay results to be finalized this week

Ashley Gold Corp. is pleased to announce entering into an option agreement to earn 100% of contiguous claims directly east of the Tabor property including the past producing Sakoose Mine subject to a 1.5% Net Smelter Royalty (NSR).

Darcy Christian, President of Ashley, commented, “I am very excited to increase our footprint in the Tabor area. Both the Tabor and Sakoose Mines are located just south of a major regional fold hinge with virtually no exploration occurring between the two. This gives us a great opportunity to build a district scale play.”

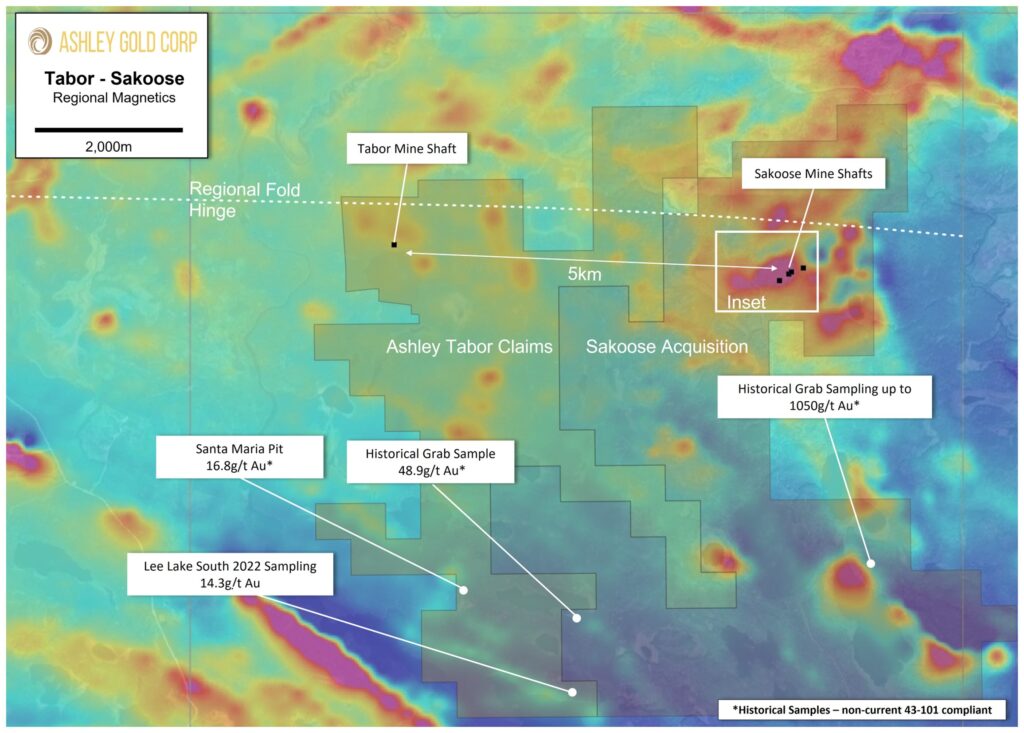

Figure 1. Location of Sakoose Option area with respect to existing claims underlain by regional magnetics.

About the Sakoose Property

The Tabor and Sakoose mines are located approximately 5km apart from each other 500m south of a major regional fold hinge (Figure 1). No drilling has occurred between these two mineralized zones and is considered greenfield exploration. In addition to the Tabor-Sakoose trend, historic grab samples have been taken to the south that likely correlate to the sampling at the Santa Maria pit and Lee Lake occurrences. The total combined property at over 4,000 hectares has the potential for district scale discoveries.

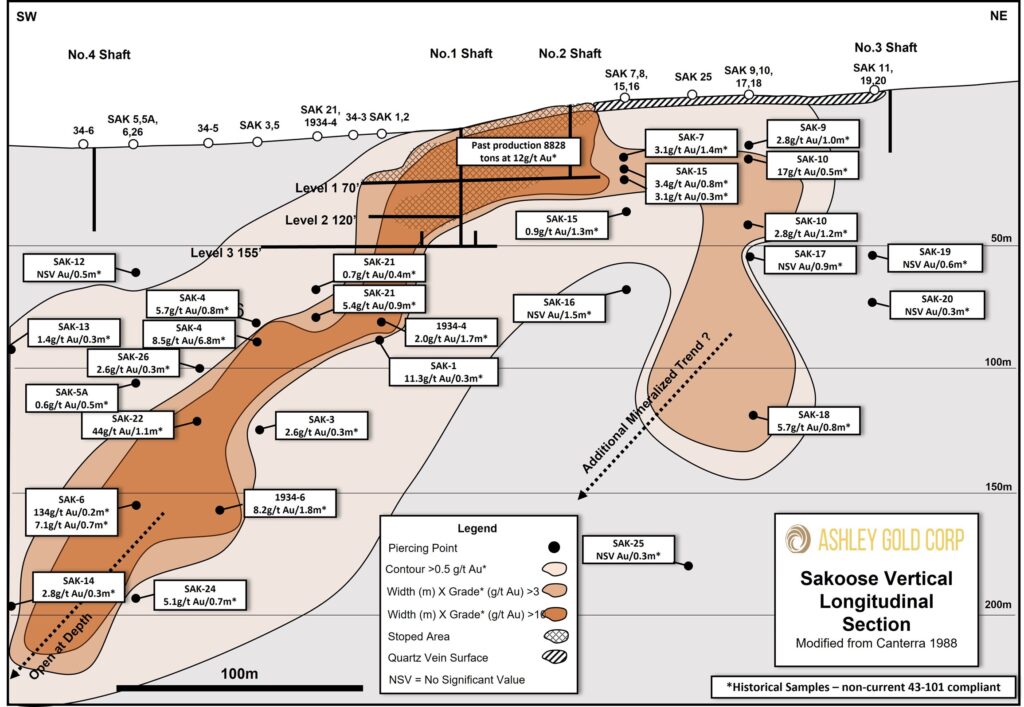

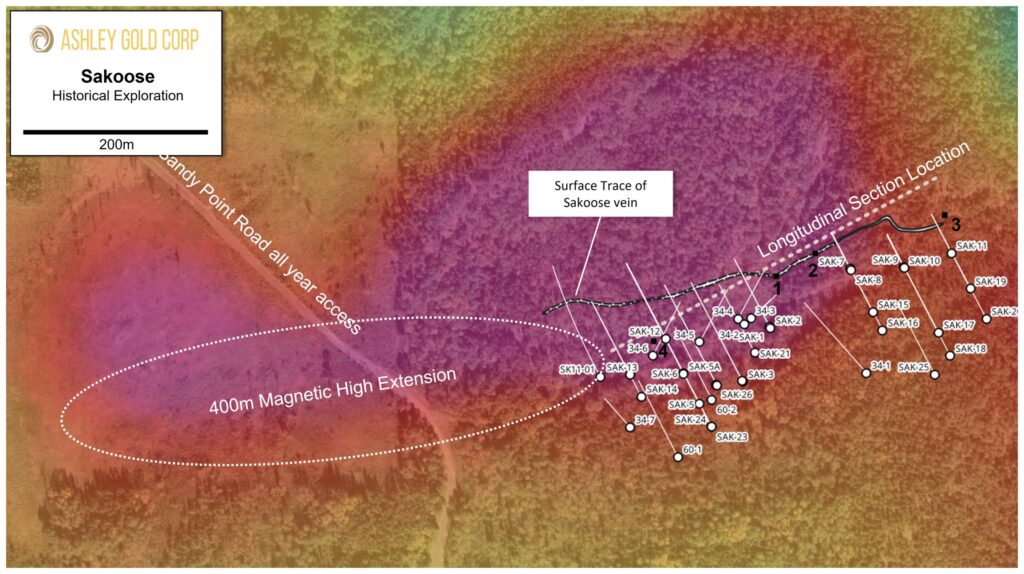

The Sakoose Mine is located 7.5km south of Highway 17 on the Sandy Point Road providing year-round access. The mine produced from 1897 until 1902 when the mill burned down. Total production is reported at 8,828 tons with an average grade of 11.9 g/t Au*. Historical drilling reporting is incomplete, however in 1988, a drill program was completed testing below the known workings. Many of these intercepts showed continuation of mineralization down to 200m vertical depth (Figure 2). Potential for an additional trend is seen from the SAK-18 intercept. Figure3 shows an east-west magnetic anomaly that is trending with the main Sakoose vein. This anomaly extends approximately 400m west of the known drilling which has the potential for vein continuation along strike.

Darcy Christian, President of Ashley, commented, “The Sakoose property has a lot of untested potential in my opinion. The known mineralization is open below 200m as well as to the west with a magnetic anomaly correlating with the main Sakoose vein trend. I look forward to testing the Sakoose area in an upcoming drill program.”

Figure 2. Longitudinal Section of the Sakoose Mine with 1988 drill results.

Figure 3. Inset Figure 1. Historical exploration of the immediate Sakoose mine area and Location of section.

Terms of the Sakoose Option

$8,000 cash payment and 200,000 shares on execution of agreement

1st Anniversary – $12,000 cash payment

2nd Anniversary – $18,000 cash payment

3rd Anniversary – $30,000 cash payment or, at election of Ashley, $14,000 cash payment and $20,000 payable in shares based on previous 20-day Volume Weighted Average Price (VWAP)

1.5% Net Smelter Royalty (NSR) with option to purchase 0.5% back at $600,000 reducing NSR to 1%

The property is underlain mainly by mafic metavolcanics in the western half of the grid and mainly felsic to intermediate metavolcanics in the east. Small amounts of clastic metasediroantary rocks were noted in three outcrops on the property. The volcanics

have been intruded with numerous plugs and dikes of quartz-feldspar

porphyry.

Ashley Gold Receives Howie Exploration Permit and Ontario Junior Exploration Program Funding Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the

Ashley Gold Announces Financing for Spring Exploration Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) announces a non-brokered private

Ashley Gold Outlines Spring 2024 Exploration Program Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) is pleased to provide

Ashley Intersects High-grade 41 g/t Au with Visible Gold at the Tabor Property Maiden Drill Program Highlights TL-23-001 intersects

Ashley Expands Tabor Property with Option on Former Producing Sakoose Mine Highlights Option incudes a 5km fold hinge trend

Ashley Announces Completion of Drilling Highlights 550m of DDH NQ completed over 5 holes Core has been sampled and