Ashley Assays Acerson Workings with over 1.2% Uranium at Sahara Property Utah

Ashley Assays Acerson Workings with over 1.2% Uranium at Sahara Property Utah Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the

Emery County

Uranium-Vanadium

Advanced – Resource Definition – Production

Earning 100% Interest

40² Kilometres

Sandstone Channel Hosted

Ashley Gold Corp

Mine modernization – Infill and Step Out Drilling.

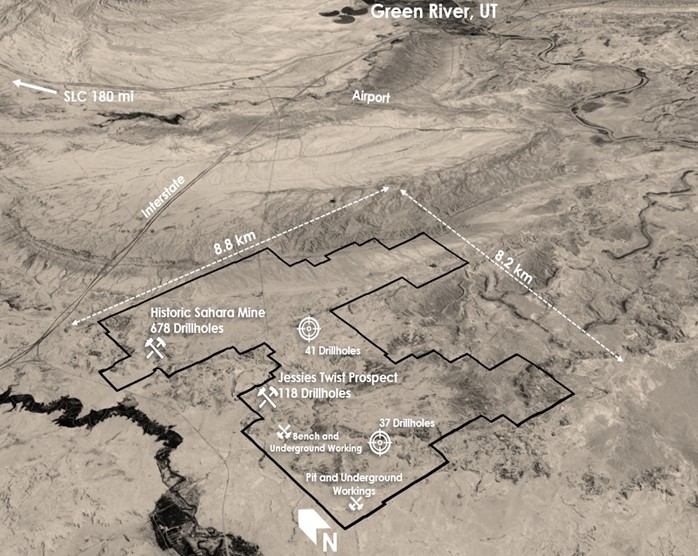

The Sahara Property is located 12 miles southwest of Green River, Utah and consists of over 400 claims totalling over 10,000 acres. The region has produced 4,000,000 lbs of Uranium and 5,000,000 lbs of Vanadium with some historical production occurring on the Property until 1980. The Project is located one mile off of the I-70 and is accessed by state and county maintained paved roads as well as all weather gravel roads. Water wells are located on the property as well as power. In addition, a nearby telecommunicaions tower and fibre optics at the property provide internet and phone access.

Original mine was developed in the late 1950s. Energy Fuels acquired the property and did extensive drilling in the 1970s. In the late 70s Energy Fuels developed the mine plan and drove an adit to the primary ore body. They also put a drive over to the 1959 mine workings. There are more than 1,175 meters (3855 feet) of access drives. Energy Fuels mined some ore from the original 59 workings. Uranium prices dropped so mining was suspended. Prices stayed low long enough that eventually Energy Fuels dropped the project.

Ashley is actively assessing the mine to determine the path to production. It is anticipated that production could commence late 2025 or early 2026.

Powered By EmbedPress

Highlights

*Historical drill data currently non-43-101 compliant

Declines and Workings

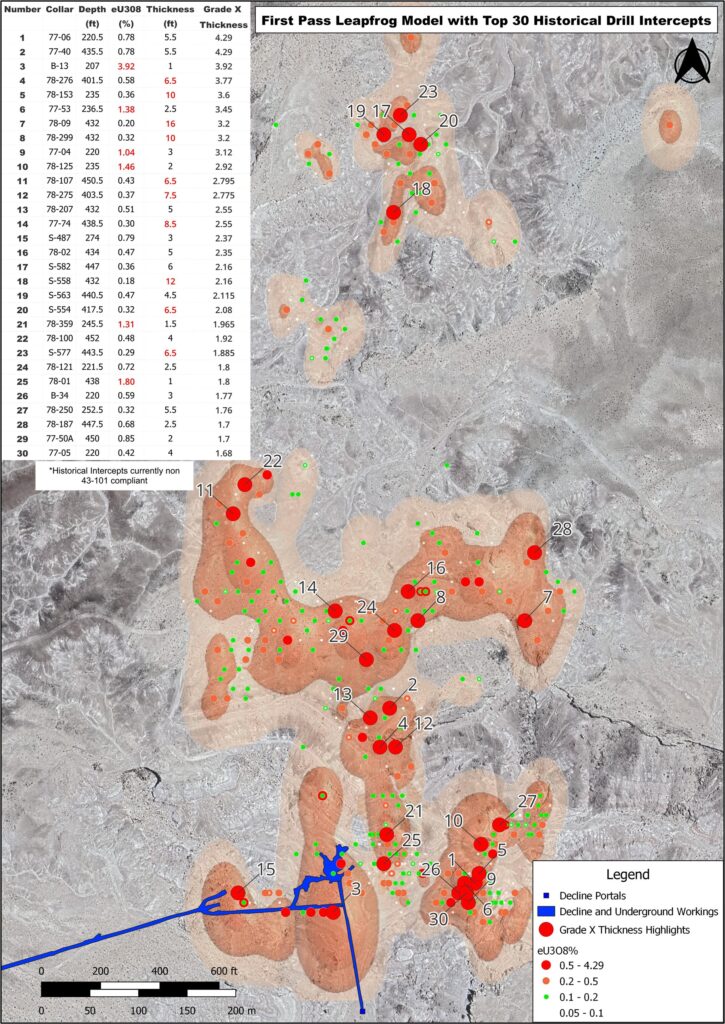

Figure 1 shows the declines to the ore bodies and underground workings in blue. The original decline running roughly south to north was used to produce ore out of the mine until 1977. Energy Fuels drove an 800m (2,600ft) low angle decline into the deposit in 1979 for higher haulage rates (west-east). The older decline was used for a secondary exit and air circulation. The production operation was put on standby due to the Three Mile Island incident in 1979. Focus was put on expansion of the Sahara reserve in anticpation of Uranium price rebound however this did not occur with prices falling below 20 US dollars a pound for two decades. It is Ashley’s intent to reopen the modern decline in the near future to evaluate the decline and workings.

Historical Drilling

Energy Fuels conducted multiple drill programs over the greater Sahara property 1990 with a total of 776 holes comprising of 325,988 ft (~99,000m). In today’s dollars this represents and expenditure of $15-20 million in exploration drilling. Drill density was as tight as 10m over the reserve area with almost 400 holes exceeding 0.1% eU3O8*. Highlights of the top 30 holes ordered by Grade X Thickness (ft) are outlined in Figure 1. Grade as high as 3.92% eU3O8* were documented as well as several intercepts over 10ft (3m). Additional programs in 2006 and 2009 were also documented and will be outlined in a future release.

*Historical drill data currently non-43-101 compliant

Historical Reserve and First Pass Modelling

By 1987 Energy Fuels outlined a historical ore reserve of almost 500,000 lb of eU3O8* at the Sahara mine. An ore reserve is defined as economically minable ore and represents a high level of confidence. Subsequent modelling in Vulcan as part of a Master’s Thesis reports a non-compliant resource of over 2,240,000 lbs of eU3O8* and nearly 4,000,000 lbs of Vanadium*. As part of Ashley’s due diligence the drill data from the Vulcan model was loaded and modelled in Leapfrog. The modelled bodies look to match the thesis model in size and shape. Infill and step out opportunities for the upcoming drill program are identified and will be used to confirm. Additional historic resources outside of the Sahara Ore-body have been documented within the Property and data for these are currently being digitized to be summarized in future releases.

Option Agreement Terms

Under the terms of the Agreement, Ashley has the right to acquire a 100% undivided interest in the Property through staged cash and share payments, plus minimum work expenditures totaling USD $10 million over a three-year period, as summarized below:

To earn an initial 30% interest to the Property:

To earn a 50% interest to the Property:

To earn 100% of the Property:

In addition to the 100% earn-in, Ashley has agreed to issue additional common shares to San Rafael based on certain economic Uranium Resource identified in a Preliminary Economic Assessment, as follows:

Upon completion of the acquisition of a 100% interest in the Property, Ashley will grant a 2% Net Smelter Return Royalty (the “NSR”) to San Rafael. Ashley will have the option to buy back 50% of the NSR for USD $2,000,000 prior to the commencement of commercial production.

As a prerequisite to executing the Agreement, Ashley has entered in to an investor rights agreement with San Rafael which gives San Rafael the right to participate in future financings on equal terms as well as the right to top up their equity position in any dilutive issuance (i.e., convertible securities) at the average 20-day Volume Weighted Average Price to maintain minimum ownership percentage. San Rafael shall also have the right to nominate a director to join the Board of Directors as Chairman upon initial earn-in, subject to regulatory approval.

Geological conditions and processes leading to the formation of primary mineralization, particularly uranium deposits, in the Sahara area were formed by ancient braided river systems, coupled with geological forces and volcanic ash deposits, created favorable conditions for uranium fixation in sandstone aquifers. The presence of humic acid, sulfur-reducing bacteria, and chemical reactions facilitated the concentration of uranium in the aquifers. There is the possibility for secondary roll-front mineralization and the potential for significant uranium deposits in the Salt Wash Graben.

Primary Mineralization

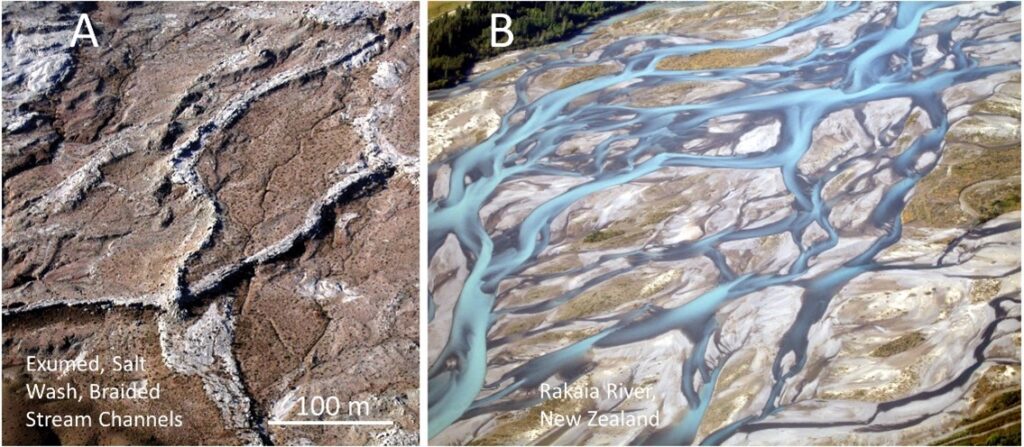

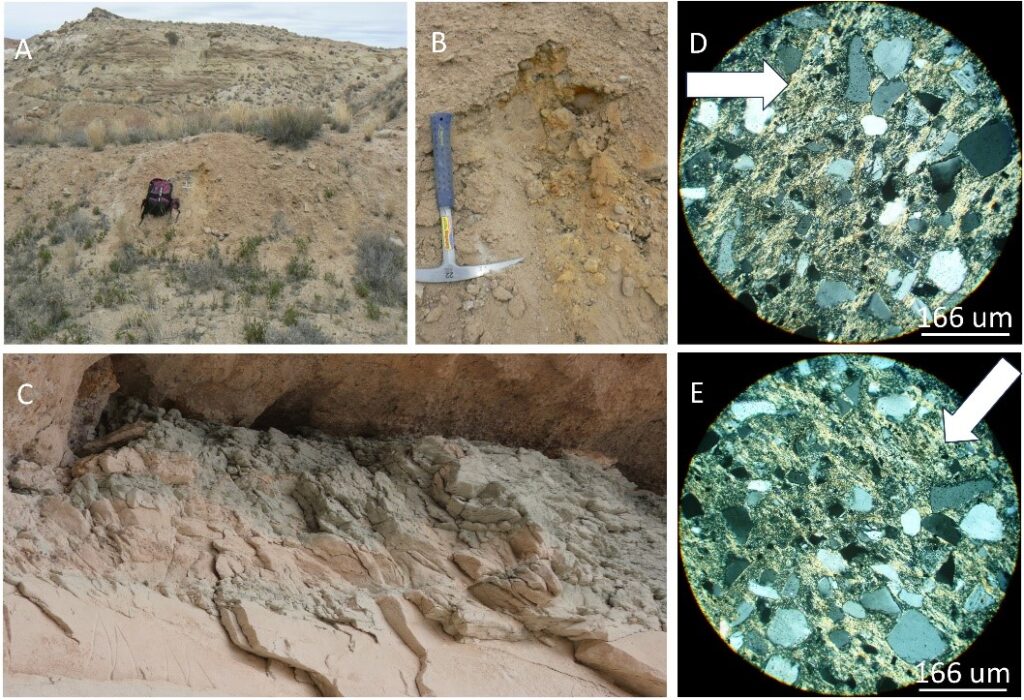

The primary ore bodies in the Sahara area are found along ancient braided river systems that left sandstone channels in the Jurassic Salt Wash member of the Morrison Formation (Figure 1).

Figure 1 – Mineralized channel sandstones. A. Braided, channel sandstone outcrop south of the Sahara Mine. [1] B. The Rakaia River, New Zealand, is a modern braided stream system analog. [2]

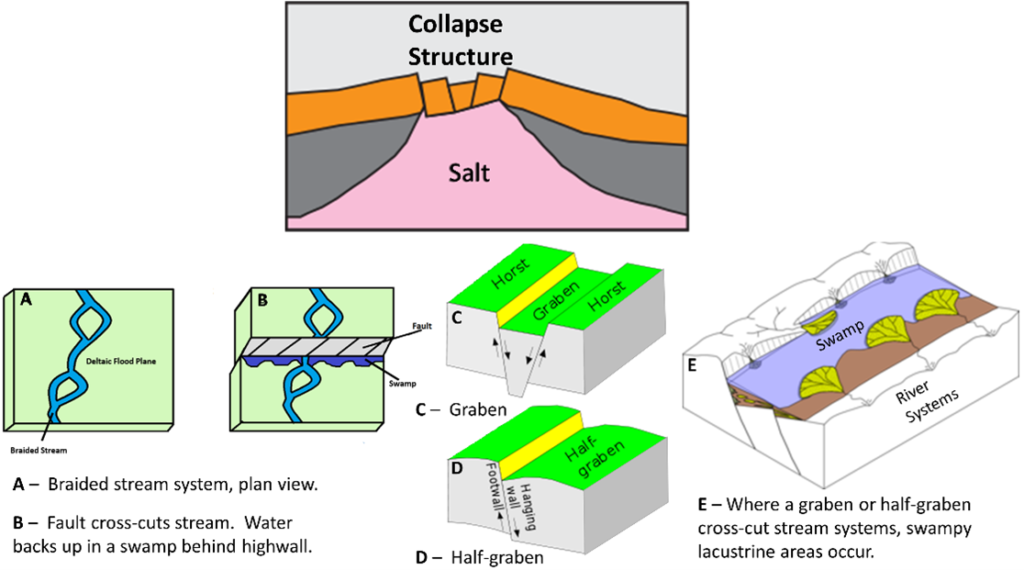

As these ancient rivers traversed across local collapse structures and faulting, they developed widespread swamps. Pliable salt thousands of feet deep in the Paradox Member was pushed up into deep-seated anticlines and domes by ancient geologic forces. Groundwater flowing in from the west “shaved” or dissolved off the tops of these salt structures, leaving large void spaces in the subsurface. Overlying rock formations fell into the voids under gravity, and this collapse cascaded to the surface. This created long down-dropped areas at the surface called grabens (German for grave) over the deep salt anticlines, or semi-circular collapse structures over the salt domes. When the ancient river systems traversed over faulting associated with collapse structures, ponding, and swamps were created (see Figure 2).

Figure 2: Salt collapse structures and swamps. Top. Groundwater “shaves” deep salt structures, creating a void filled by the collapse of overlying strata. A. and B. Faulting along a collapse structure crossed by a river causes ponding and swamps against a high wall. C. Collapse graben along a salt anticline. D. Collapse half-graben. E. Swamp along half-graben redirects stream flow. [3]

During this same time in the Late Jurassic Morrison period, volcanic ash from volcanos in the Arizona Mogollon Highlands was falling into Sahara swamps (Figures 3 D. and E. Also see Figure 5). Humic acid produced in the swamps was a natural solvent that leached and fixed uranium from the ash into its molecular structure. This mineralizing fluid fell into the channel sandstone aquifers under gravity or was forcefully injected as the surrounding and overlying swamp shales (Figures 3 A., B., and C.) were compacted. This happened during early diagenesis in the Cretaceous Era, after the ancient river systems had been buried by weighty, overlying sediments and oceans. The top weight caused the compaction of the swamp shales that released mineralizing fluids into the aquifers.

Figure 3- Swamp shales. A. Buckskin colored shale in Lower Brushy Basin directly above a Salt Wash channel at Acerson Open-pit Mine, a few miles south of Sahara. B. Orange, oxidized pyrite infused with black humate in Brushy Basin source shale. C. Green, reduced swamp shale interbedded with sandstones of the Jessies Twist channel. D. and E. Photomicrographs of Volcanic ash in the matrix of swamp shale (transmitted light, slide rotated to different extinction angles). [3]

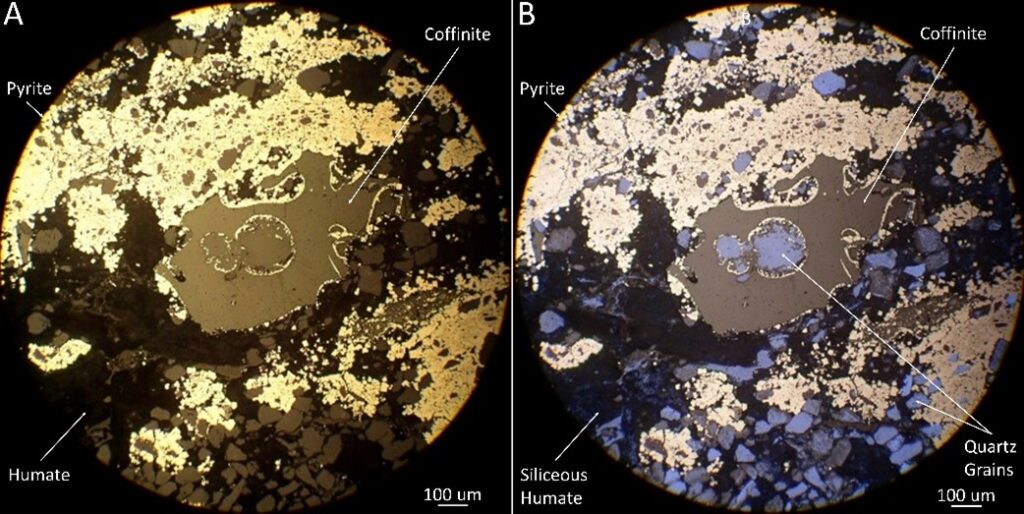

After chemically reducing, uranium-rich humic acid came into the sandstone aquifers, it was attacked by a symbiosis of sulfur-reducing bacteria and archaea that used it as an energy source. Uranium was released into the chemical milieu. Humic acid dissolved aquifer sand grains, producing silica gel (Compare Figures 4 A. and B.). Abundant pyrite was also formed by the sulfur-reducing bacteria, and residual, siliceous humate is also common. Chemical tests have shown this “asphaltite”, as it was called by the early miners, at it is humate, the solid form of humic acid.

Figure 4: Sahara mineralization thin-section photomicrographs. A. Coffinite (uranium silicate) pools and coated sand grains mingled w/pyrite and humate (reflected light). B. Quartz grains revealed beneath coffinite coatings (reflected light + blue-filter transmitted light). [3]

Figure 5 – Sahara Canyon. The flats in the foreground is the top of the Salt Wash Member, the badlands in the background are the Brushy Basin Member of the Morrison Formation. The Brushy Basin is devoid of vegetation because its clays have such high volcanic ash content, they become swelling clays or bentonites, which expand when they get wet. Every year they swell from winter show-melt and pinch off roots from tops of plants, which can never get started.

Exploration for Secondary Roll-Front Mineralization

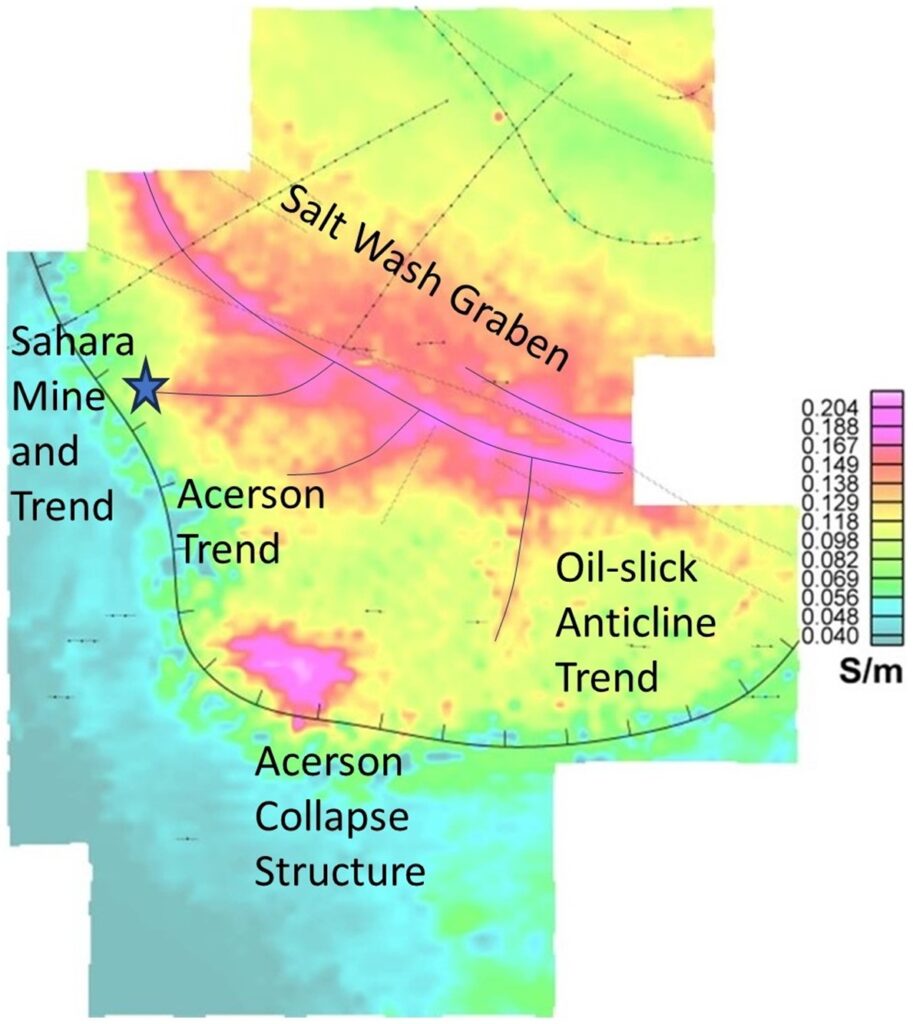

Airborne, electrical resistivity geophysics of the project area (Figure 6) indicates three major, braided stream systems coursed through the central portion of the San Rafael River Mining Area in Late Jurassic time; the Sahara, Acerson, and Oil-slick Anticline channel trends.

The most prominent features in the geophysics are the Acerson collapse structure to the south and the Salt Wash Graben in the central area. The ovoid Acerson collapse structure is a collapse over a shaved salt dome at depth. Wildcat exploration drilling in 2009 in its northwest corner intersected a new, high-grade uranium trend with primary mineralization similar to the Sahara. The Salt Wah Graben is a regionally extensive, linear collapse graben over a deep-seated, shaved salt anticline. It is little explored, except in the northwest corner of the survey where the Conoco Section 36 deposit is located slightly north of the Graben. Thus, primary uranium mineralization is associated with both prominent collapse structures, and both are important targets for continued exploration.

Drilling has also shown that the Salt Wash Graben is itself a channel sandstone over 100’ thick. The geophysics indicates that three channel systems in the Salt Wash Member of the Morrison Formation coming in from the south confluenced with the Graben, which re-directed their stream flow eastward along its path. This also provides a present-day “plumbing system” for groundwater flowing through the three, uranium mineralized aquifers coming in from the south; it is all re-directed eastward into the Salt Wash Graben. This modern groundwater originates mostly in the San Rafael River, which flows along the western edge of the project area. Oxidized water leaks into the channel aquifer systems where the San Rafael River cuts across the Salt Wash outcrops.

Figure 6- 125m depth slice of the Fugro, Airborne resistivity geophysics. Hotter colors represent more conductive strata. The sandstone channel systems, formerly river systems in the Late Jurassic Salt Wash Member of the Morrison Formation are the Sahara Trend, the Acerson Trend, and the Oil-slick Anticline Trend. Salt collapse structures have the highest (purple) conductivity. They are the Acerson Collapse structure, a salt collapse dome in the south, and the Salt Was Graben, a salt collapse anticline through the central area of the survey. The conductivity of normally resistive sandstones results from salt solutions leaking into these Salt Wash Member sands from the salt structures at depth. [4]

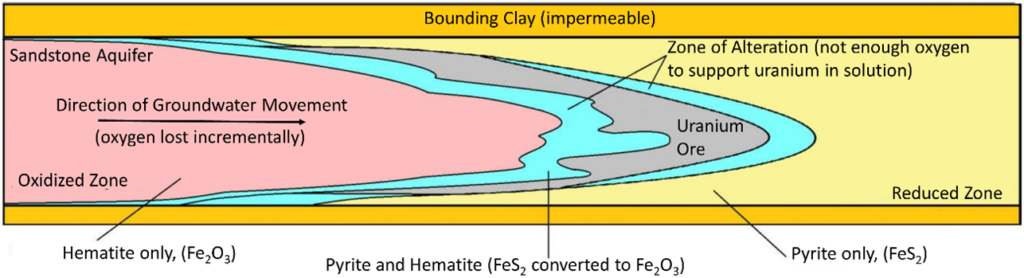

Oxidized groundwater is capable of dissolving parts per billion amounts of uranium from the mineralized channel trends, carrying it northward and eastward into the Salt Wash Graben. Along this path, oxygen is gradually removed from the groundwater until there is no longer enough to support uranium in solution, and it falls out and is fixed in the sandstone aquifer as a roll-front deposit. The de-mineralized water continues down the aquifer. As this process continues to occur over time, uranium builds up at the roll-front, forming a large deposit (see Figure 6). Thus, the potential for a significant, secondary roll-front deposit in the Salt Wash Graben downdip from the Sahara, and other primary deposits in the channel aquifers, has the potential to host a world-class-size uranium deposit.

Figure 6 – Roll-Front uranium deposit explanation. This represents a channel aquifer at the oxidation/reduction zone or roll-front. Groundwater flowing through this zone has lost just enough oxygen in its traverse through the aquifer to cause uranium to precipitate from solution and become fixed in the matrix between the sand grains. [5].

References

[1] Thomas C. Jr. Chidsey, Rebecca M. E. Williams, and David E. Eby. Ancient exhumed

river channels of the Morrison and Cedar Mountain Formations. Utah Geological Survey

Notes, 40(3), September 2008.

[2] Geoff Leeming. Rakaia River, NZ. https://www.flickr.com/photos/geoff leeming/90092868/in/photolist-8XKti-8XKtj, 2006, Note – Taken from a plane taking off from Christchurch.

[3] Scott J. Hill. Genesis of a Sandstone Uranium Deposit (SUD), Metals Accumulated-Transported by Humic Acid, Deposited Biogenically: Sahara Mine, Emery County, Utah, USA, Master’s Thesis, University of Utah, Salt Lake City Utah, 2024. In final review. Courtesy of the author.

[4] Joel Grunerud. Airborne tempest interpretation report. Emery couny project 2008 geophysical airborne program, Green River area, Utah, UPC Uranium (USA) Inc., Casper, Wyoming, June 2008. Courtesy of San Rafael Resources.

[5] Samual James Crofford, Geochemical alteration associated with uranium roll-front mineralization . . . Honors Thesis, University of Adelaide, Australia, 2014.

Ashley Assays Acerson Workings with over 1.2% Uranium at Sahara Property Utah Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the

Ashley Gold Announces $1,000,000 Financing and Expands Utah Land Package Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) announces

Ashley Signs LOI with Western Uranium and Vanadium for Processing of Sahara Ore Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or

Ashley Provides Historical Drilling Summary of Sahara Utah Uranium-Vanadium Property Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) has

Ashley Gold Closes Option Agreement on the Sahara Uranium-Vanadium Property Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) is

Ashley Gold Completes Site Visit at Sahara Uranium-Vanadium Property, Emery County Utah Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the