- +1 (587) 777-9072

- [email protected]

- CSE: ASHL

Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) further to its news release dated May 10th and May 25th, 2023, the company is pleased to announce the closing of the non-brokered private placement with 5,162,915 Units for gross proceeds of $361,404.09. The Company paid a total of $20,687.51 in finders fees associated with the Offering and issued 295,536 finder warrants with an exercise price of $0.12 expiring 24 months from the closing date of the Offering.

Darcy Christian, President of Ashley, commented, “We are very excited to raise the capital needed for our Tabor Lake drill program slated for this month. The junior exploration market is currently experiencing headwinds in securing capital, but we managed to achieve our goal thanks to the hard work of the team as well as our loyal existing and new shareholder base. I am grateful and hope to reward the vote of confidence with a successful drill program”.

The Offering was completed pursuant to the listed issuer financing exemption under Part 5A of National Instrument 45-106 Prospectus Exemptions (the “LIFE Exemption”) and, therefore, any securities issuable under the LIFE Exemption are not subject to a hold period in accordance with applicable Canadian securities laws. There is an offering document related to the Offering that can be accessed under Ashley’s profile at www.sedar.com.

Certain related parties of the Company participated in the Offering. The participation in the Offering by the related parties of the Company constitutes a related party transaction pursuant to Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is exempt from the requirements to obtain a formal valuation and minority shareholder approval in connection with the participation of the insiders in the Offering in reliance on the exemptions contained in sections 5.5(b) and 5.7(1)(a) of MI 61-101, respectively.

Securing of Drill Contractor and Rig

Ashley Gold has entered contract with local contractor 518 Drilling Ltd. out of Dryden and Winnipeg for our upcoming Tabor Lake Drill program. Ashley will be drilling up to 1,000m of NQ core subject to permitting consultation. This will provide much needed modern information on the structure and mineralization of veins and ‘wall-rock’ at Tabor.

Darcy Christian, President of Ashley, commented, “We are very excited to work with 518 Drilling in our first drill program. Mike and Kevin are highly experienced and capable individuals that provide an excellent skill-set to get our program completed in a safe, environmentally responsible and cost competitive way. “I am looking forward to continued collaboration with them”.

Tabor Lake Drill Program Targets (subject to permitting consultations)

The acquisition of modern data will provide the following:

Ashley currently has a private placement open to fund its first drill program this summer on the Tabor Lease.

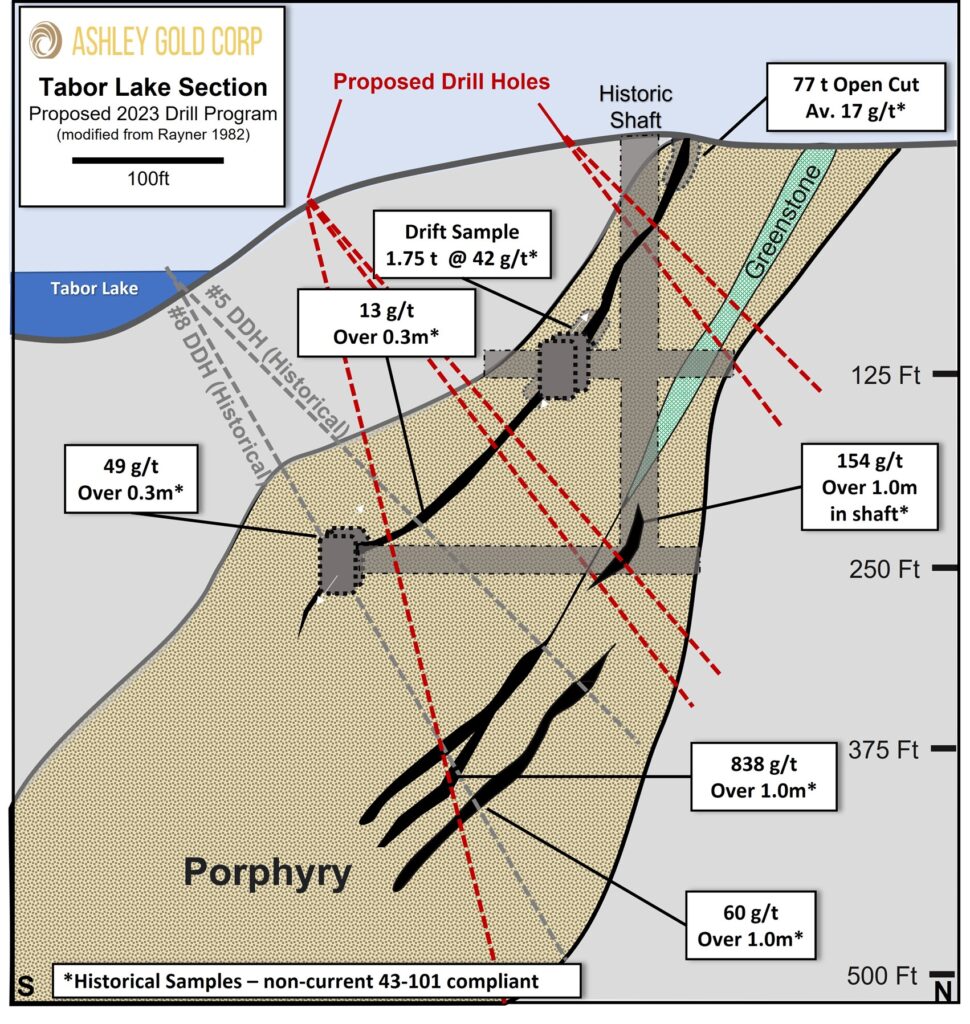

Figure 1. Conceptual Diagram of Drill Targets 2023 Drill Program (Red Dashed).

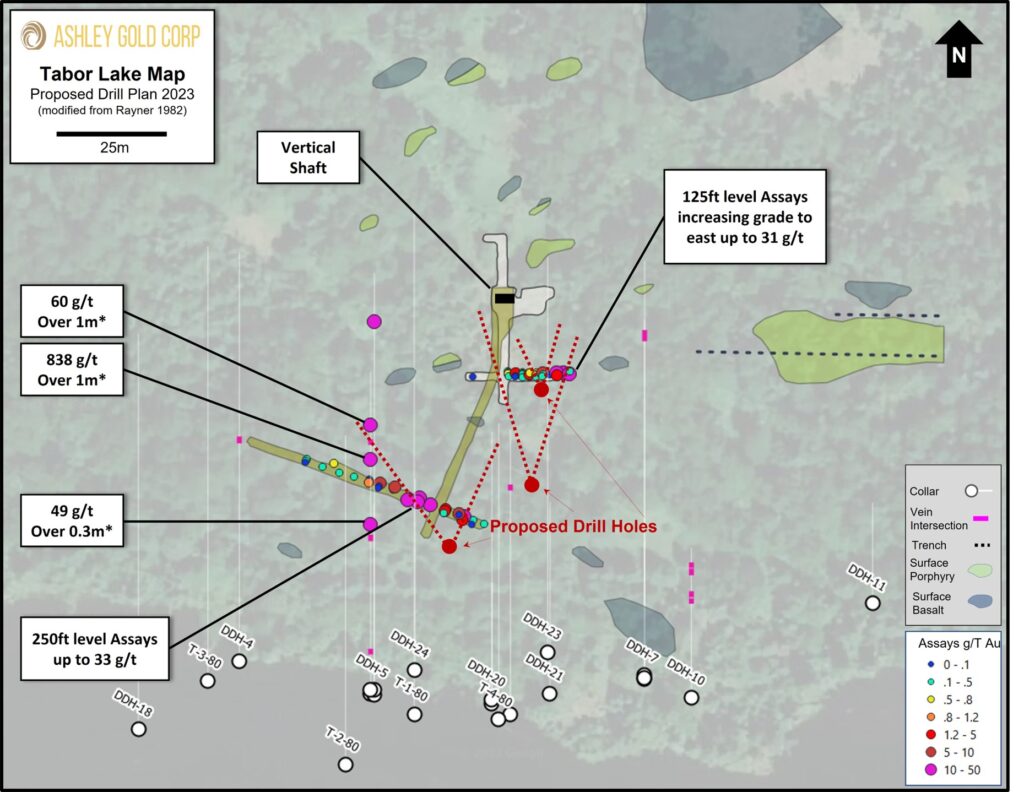

Figure 2. Proposed Drill Locations 2023 Program (Red Dashed).

Clarification on Listed Issuer Financing

Further to the company’s news release dated May 10, 2023, investors are reminded that there is an offering document related to the offering that can be accessed under the issuer’s profile at www.sedar.com and at www.ashleygoldcorp.com and can be downloaded HERE. Prospective investors should read the offering document before making an investment decision.

The Qualified Person responsible for the technical content of this press release is Shannon Baird, P.Geo, Exploration Manager of Ashley Gold Corp.

ABOUT ASHLEY GOLD CORP.

Ashley Gold is focused on creating substantive, long-term value for its shareholders through the discovery and development of world class gold deposits. Ashley has acquired, 100% of the Tabor Lake Lease subject to a 1.5% royalty, 100% of the Santa Maria Project subject to a 1.75% royalty, 100% interest in the Howie Lake Project subject to a 0.5% royalty and 100% interest in the Alto-Gardnar Project subject to a 0.5% royalty.

Ashley Gold Corp. is an early-stage natural resource company engaged primarily in the acquisition, exploration, and if warranted, development of mineral projects. The Corporation’s objective is to conduct efficient and economical exploration on its growing portfolio of high-quality gold projects, currently focused in northwestern Ontario within the Eagle-Wabigoon-Manitou Lakes Greenstone Belts.

The responsibility of this release lies with Mr. Darcy Christian, President and CEO • +1 (587) 777-9072 • [email protected] , may be contacted for further information. www.ashleygoldcorp.com

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

The Qualified Person responsible for the technical content of this press release is Shannon Baird, P.Geo, Exploration Manager of Ashley Gold Corp.

DISCLAIMER & FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management’s expectations. Factors which cause results to differ materially are set out in the Company’s documents filed on SEDAR. Undue reliance should not be placed on “forward looking statements”.